COVID Relief: What’s in it for Ag?

In the middle of the holiday season, a COVID-19 relief package was passed by Congress and signed into law by the President. For businesses curious about changes to tax credits, the Paycheck Protection Program, etc., the Lubbock Chamber will be hosting a free webinar on January 12 with Neil Bradley of the U.S. Chamber of Commerce.

Among the $900 billion in relief spending is a portion of the bill specific to agriculture. Here are some of the highlights:

- $13 billion appropriated for agriculture, with more than $11 billion directly allocated to USDA for direct payments to producers

- $20/acre of eligible price trigger and flat-rate crops

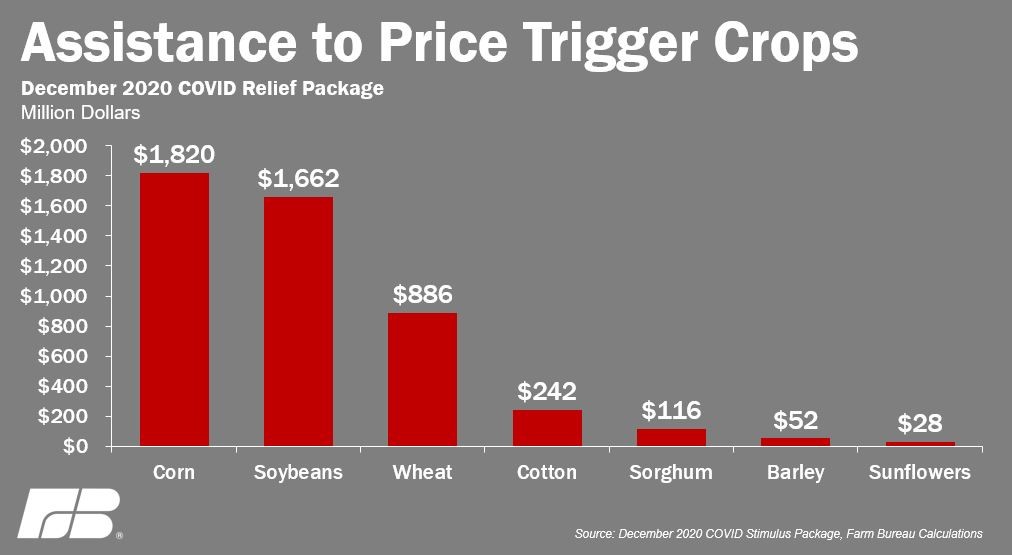

- “Price trigger” defined by the Coronavirus Food Assistance Program are major commodities that meet a minimum 5% price decline over a specified period (barley, corn, sorghum, soybeans, sunflowers, cotton, and wheat)

- $200M over 10 years for nutrition research

- $100M for Local Agriculture Market programs

- $1.5B to purchase and distribute food and ag products to individuals in needs and for grants/loans to small and midsized food processors or distributors

- Payments to cotton processors at a rate of 6 cents per pound times the average monthly consumption for 2017-2019 then multiplying by 10

- Payments to biofuel producers as production has fallen nearly 2 billion gallons since the beginning of 2020

- $75M for the Farming Opportunities Training and Outreach Program for grants for beginning, socially disadvantaged and veteran farmers and ranchers

- $28M for grants to state departments of agriculture to expand or support stress assistance programs for ag-related occupations

- Support for losses due to depopulation of animals from early in the pandemic when supply chains were stressed